- Code Your Wealth

- Posts

- 3 Big Wins That Make AT&T’s Dividend a Smart Bet Right Now

3 Big Wins That Make AT&T’s Dividend a Smart Bet Right Now

Discover why AT&T's 5% dividend is becoming a safer choice each quarter, with key financial wins paving the way for a more stable, reliable income stream.

If you've got your eye on AT&T for its impressive 5% dividend yield, you're not alone.

But with any high yield, there’s usually a bit of risk.

Thankfully, AT&T is turning that risk dial way down.

The latest earnings report shows the telecom giant is shoring up its financials, making its dividend more dependable each quarter.

Let’s dive into why AT&T’s payout is looking stronger and safer than ever.

Before we dive into why AT&T’s payout is stronger and safer than before, check out Bullseye Trades—a top-tier daily trade alert service trusted by 210,000+ traders! Get the hottest stock tips straight to your phone for free and stay ahead in the market.

Navigate the Stock Market with these Free Daily Trade Alerts

Master the market in 5 minutes per day

Hot stock alerts sent directly to your phone

150,000+ active subscribers and growing fast!

First, the Basics: Some Wins, Some Hiccups 📊

On the surface, AT&T’s latest quarterly results seem mixed.

Revenue dipped by 0.5% to $30.2 billion, and adjusted earnings per share dropped to $0.60 — a 6.3% decline from last year.

Even cash flow had a slight hiccup, with operating cash flow and free cash flow each down just over 1%.

But here’s where things get interesting:

Growth in Key Areas: Adjusted EBITDA rose 3.4% to $11.6 billion, driven by solid performance in mobile and fiber segments.

Mobility Momentum: Mobility revenue climbed 4% to $16.5 billion. Consumer broadband? Up 6.4% to $2.8 billion.

Fiber Gains: Despite some bad weather and a strike in the Southeast, AT&T added over 200,000 fiber customers for the 19th straight quarter!

AT&T’s cash flow is also improving steadily.

Though free cash flow dropped a bit to $5.1 billion this quarter, it’s grown by $2.4 billion year-to-date compared to last year.

T’s Free Cash Flow Chart from YCharts

This boost allowed AT&T to reduce its net debt by $1.1 billion this quarter and $2.9 billion year-over-year.

With these financial strides, AT&T’s dividend security keeps getting stronger.

Second: More Improvements on the Horizon 🌅

AT&T's financial outlook is still looking up.

With the mobile and fiber segments performing well, cash flow and earnings should keep increasing, helping reduce debt.

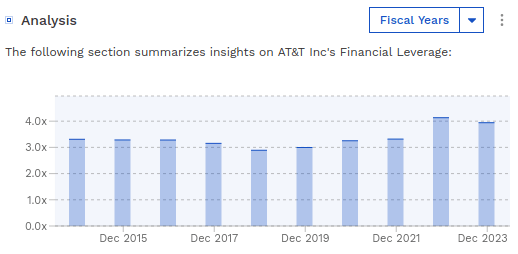

The company aims to lower its leverage ratio to 2.5 times by early next year, matching competitor Verizon’s current level.

T’s Financial Leverage from Finbox

Unlike Verizon, however, AT&T’s leverage ratio should stay on a downward path, giving it a big edge over time.

A recent deal to sell AT&T's remaining DIRECTV stake will bring in $7.6 billion, which will be used to further pay down debt.

With this extra boost to the balance sheet, AT&T could be ready to increase its dividend again.

Third, A Stronger Dividend Foundation 🏛️

AT&T’s CEO John Stankey summed it up well in the earnings report:

“We are investing at the top of the industry, reducing debt, and growing free cash flow year to date.”

As AT&T makes these improvements, it’s laying a stronger foundation for its high-yield dividend.

T’s Dividend History from Morningstar

Sure, Verizon still holds the upper hand with its long track record of dividend growth, but AT&T’s gains show it could soon be a serious contender.

For income investors seeking a steady payout, AT&T is becoming a much safer bet.

Takeaway 📌

AT&T is steadily building up its dividend security.

With a focus on debt reduction, fiber growth, and solid performance in mobility, the future looks bright for this telecom giant.

The question now is: Will AT&T close the gap with Verizon and start boosting its dividend once again?

What are your thoughts on AT&T’s dividend potential?

Do you think AT&T will soon match Verizon’s dividend growth track record?

Let’s discuss in the comments!

And if you found this article helpful, please share it on social media to spread the word.

Join the Super Investor’s Club for more insights like these — click here to join!

Want to master options trading? Check out The Ultimate Options Strategy Guide — it’s packed with everything you need to succeed.

Feel like supporting my content? Buy me a coffee ☕

Code. Grow. Prosper.

Reply